Working capital loans are a lifeline for small businesses, providing the funds needed to cover day-to-day operational costs. Whether you need to manage cash flow, purchase inventory, or handle unexpected expenses, these loans can make a significant difference. In this article, we will explore working capital loan options from five major banks in the USA, detailing loan amounts, interest rates, repayment terms, and how to apply.

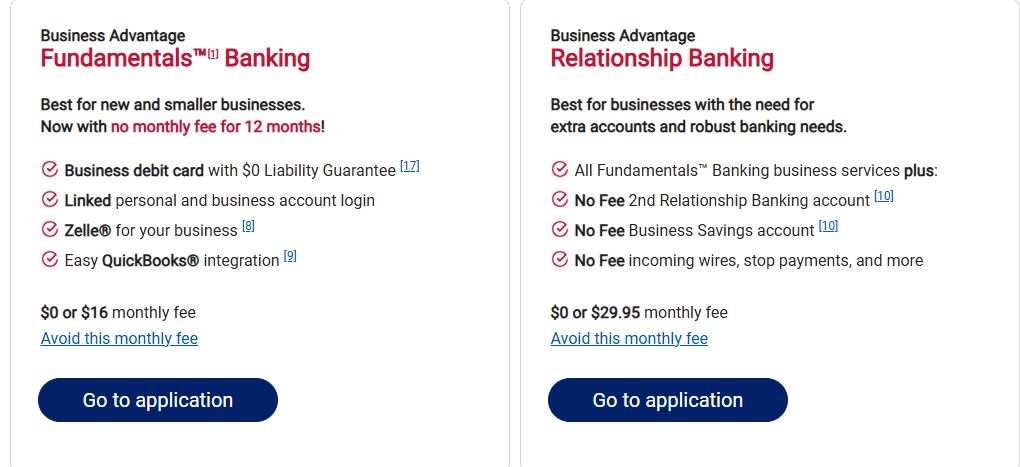

1. Bank of America

Loan Amount: $10,000 – $100,000

Interest Rate: Starting at 4.25% APR

Repayment Terms: 6 months to 5 years

Features: Bank of America offers flexible repayment terms and fast funding. Small businesses can benefit from lower rates if they have a strong credit score.

How to Apply: Apply for a Working Capital Loan at Bank of America

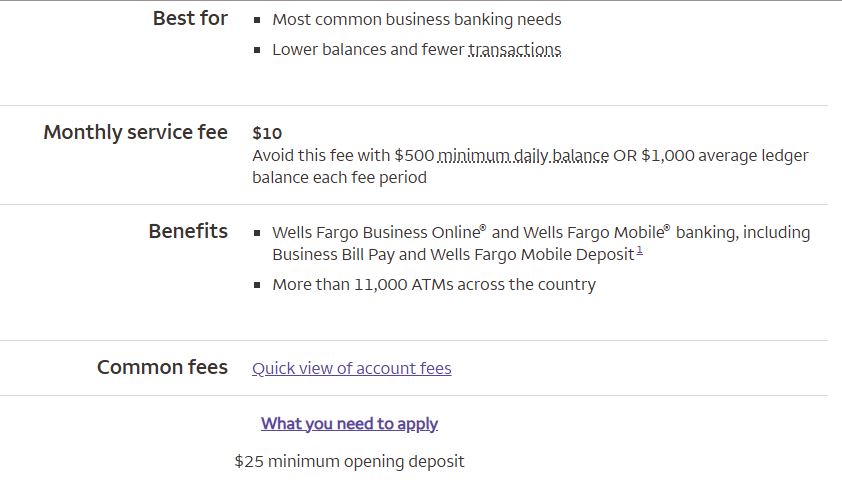

2. Wells Fargo

Loan Amount: $5,000 – $500,000

Loan Amount: $5,000 – $500,000

Interest Rate: Starting at 5.00% APR

Repayment Terms: 1 to 7 years

Features: Wells Fargo provides tailored solutions for small businesses. Their online application process is straightforward, and funds are typically available within 48 hours of approval.

How to Apply: Apply for a Working Capital Loan at Wells Fargo

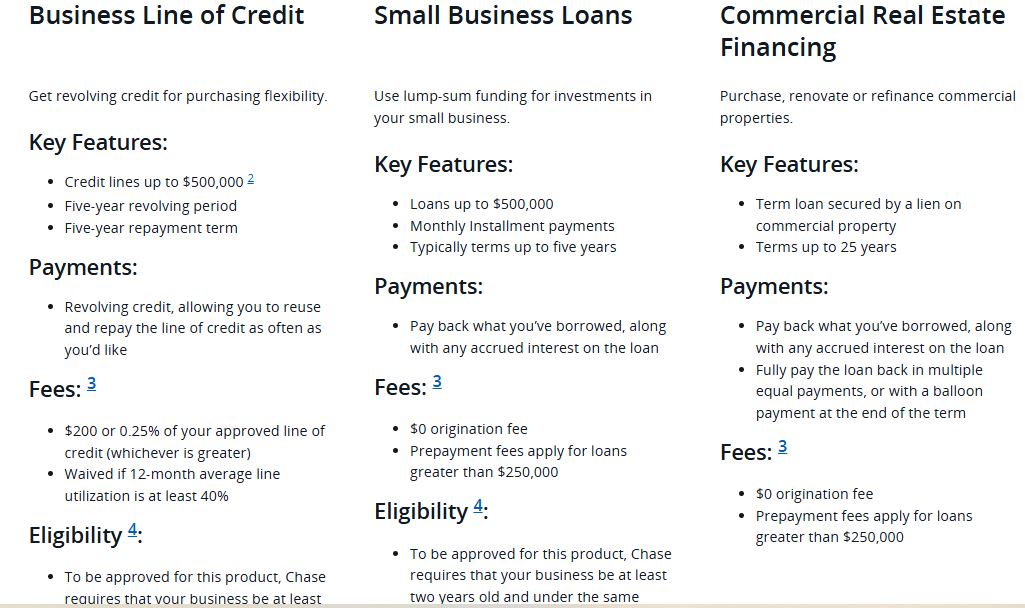

3. Chase Bank

Loan Amount: $10,000 – $250,000

Interest Rate: Starting at 4.75% APR

Repayment Terms: 12 to 60 months

Features: Chase Bank offers competitive rates and access to additional business resources, including financial planning tools.

How to Apply: Apply for a Working Capital Loan at Chase Bank

4. U.S. Bank

Loan Amount: $25,000 – $1,000,000

Interest Rate: Starting at 6.25% APR

Repayment Terms: 6 months to 7 years

Features: U.S. Bank specializes in high-value loans, ideal for businesses with larger capital needs. They also offer lines of credit for more flexible funding options.

How to Apply: Apply for a Working Capital Loan at U.S. Bank

5. TD Bank

Loan Amount: $10,000 – $500,000

Interest Rate: Starting at 5.50% APR

Repayment Terms: 6 months to 5 years

Features: TD Bank provides both secured and unsecured working capital loans. Their customer service is highly rated, offering personalized assistance throughout the application process.

How to Apply: Apply for a Working Capital Loan at TD Bank

Tips for Applying for a Working Capital Loan

- Prepare Your Documents: Ensure you have all required documents, such as financial statements, tax returns, and a detailed business plan.

- Check Your Credit Score: A higher credit score can lead to better interest rates and terms.

- Compare Offers: Evaluate different banks to find the best deal that suits your business needs.

- Consult a Financial Advisor: Seek professional advice to ensure you’re making the right decision.

Conclusion For Working Capital Loans

Working capital loans can empower small businesses to thrive, even during challenging times. By exploring options from reputable banks like Bank of America, Wells Fargo, Chase, U.S. Bank, and TD Bank, you can find a loan tailored to your business needs. Take the time to review terms, interest rates, and repayment options before making a decision. With the right loan, your business can achieve sustained growth and stability.